The Web3 gateway to capital markets

Track stocks, ETFs, and stablecoins all in one wallet

Apply for Early Access

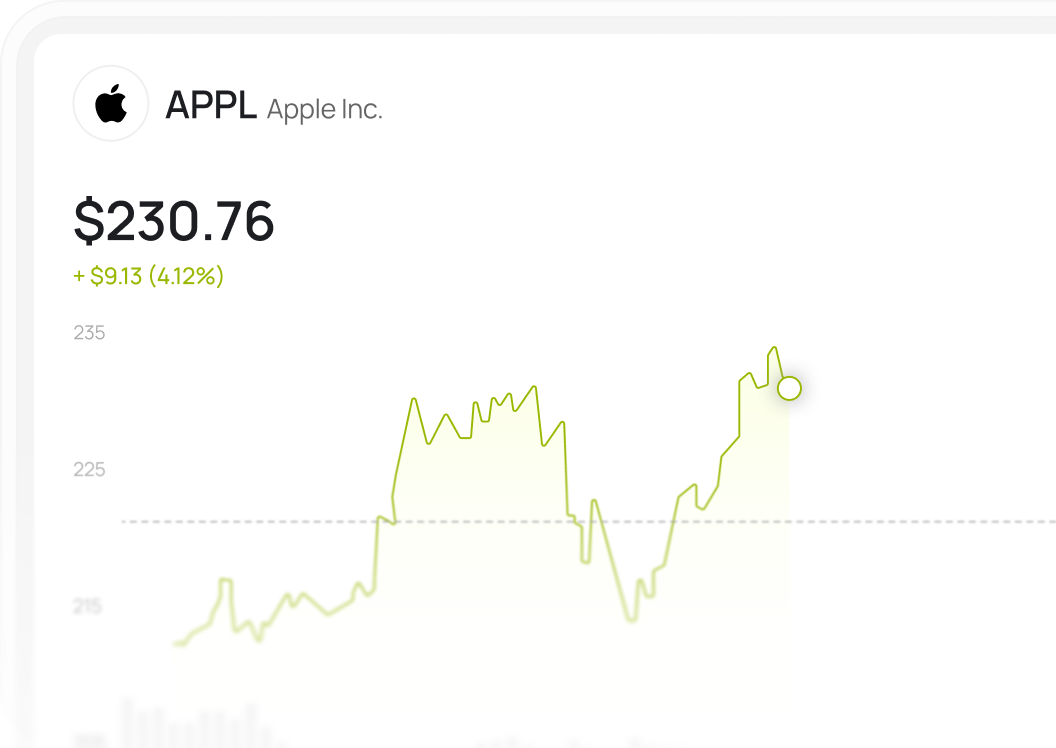

Own a piece of the world’s most traded companies

Coming soon

Dow Index

44,458.30

+217.54

0.49

%

S&P 500 Index

6,263.26

+37.74

0.61

%

NASDAQ Index

6,263.26

+192.87

0.94

%

Disclaimer: The information displayed is not real-time data.

TSLA

TSLA

TSLA

TSLA

TSLA

MSFT

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

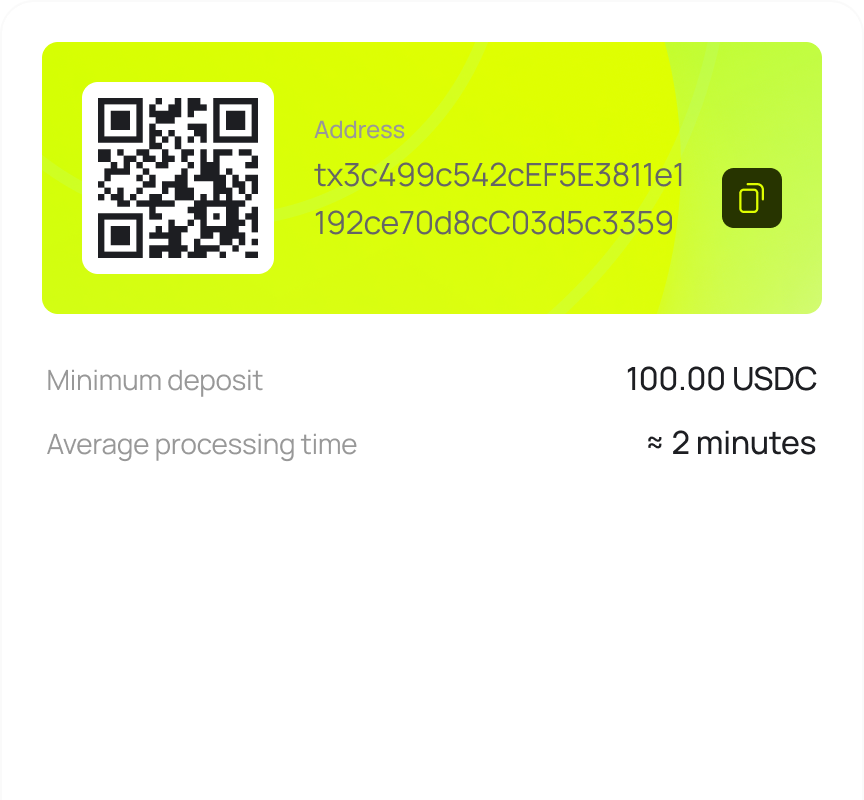

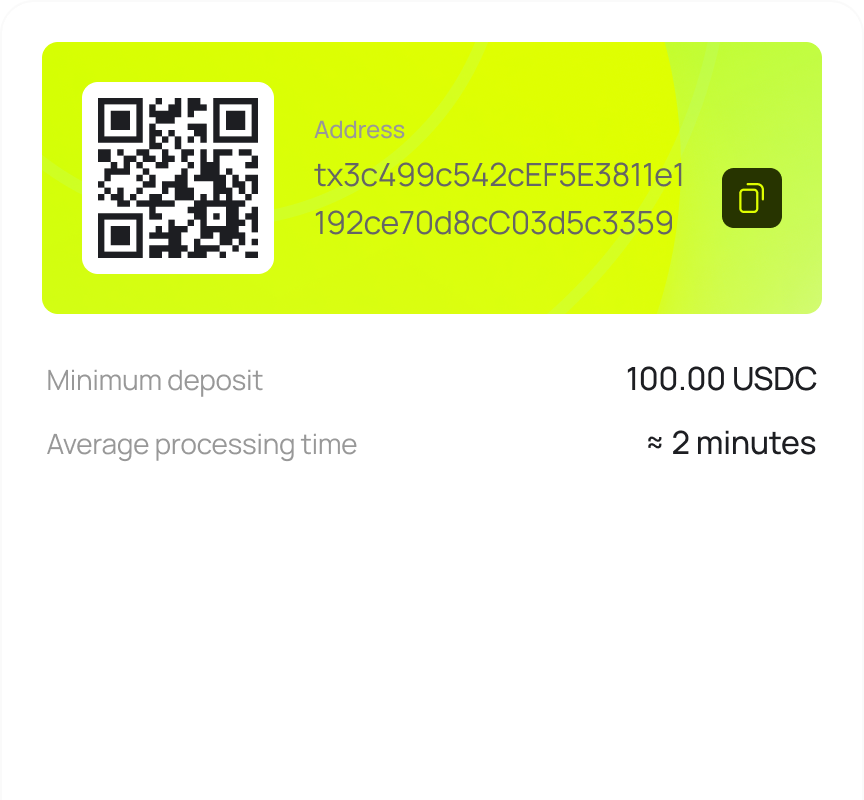

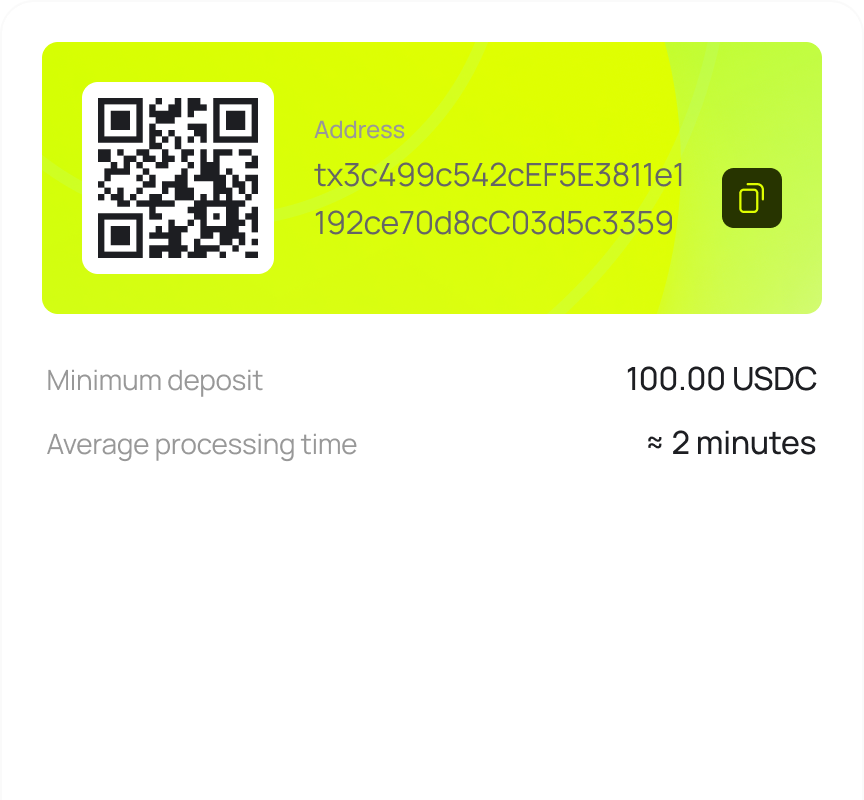

Skip the bank

Access stocks with USDC. No waiting, no friction.

Trade under a fully regulated US-based broker

Texture Capital adheres to strict U.S. securities regulations, aiming to meet the highest standards of compliance on every transaction. With SoloTex, the firm introduces a modern investment platform designed for Web3 users.

FINRA Broker Check

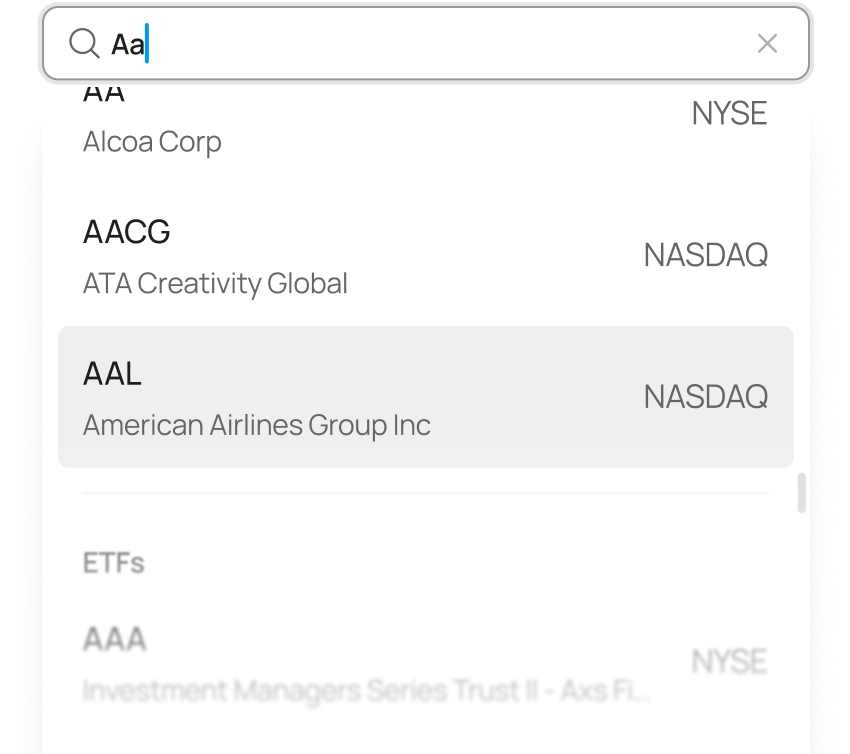

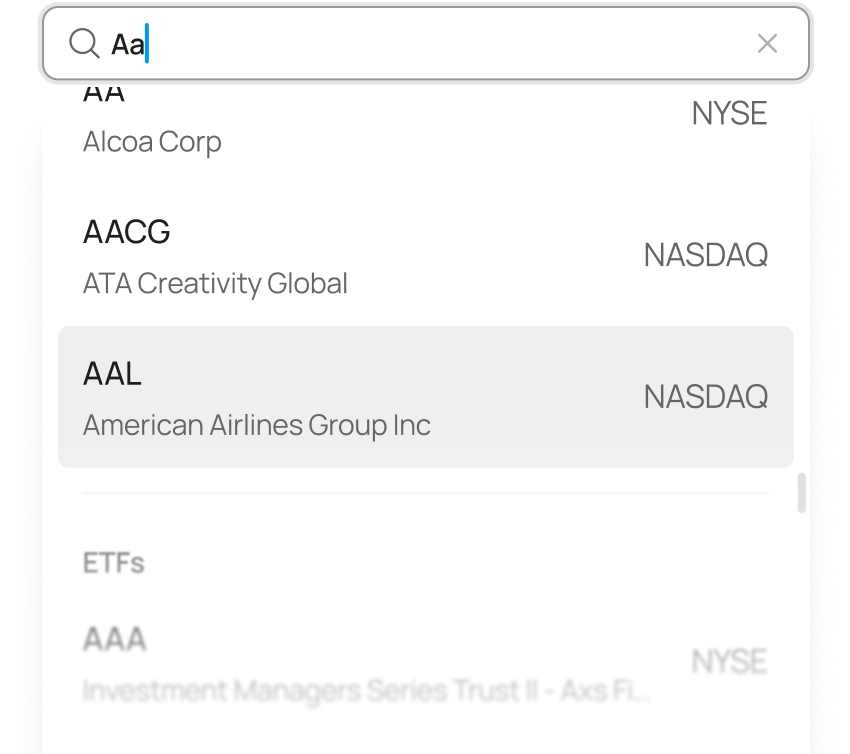

Everything you need to trade stocks on-chain

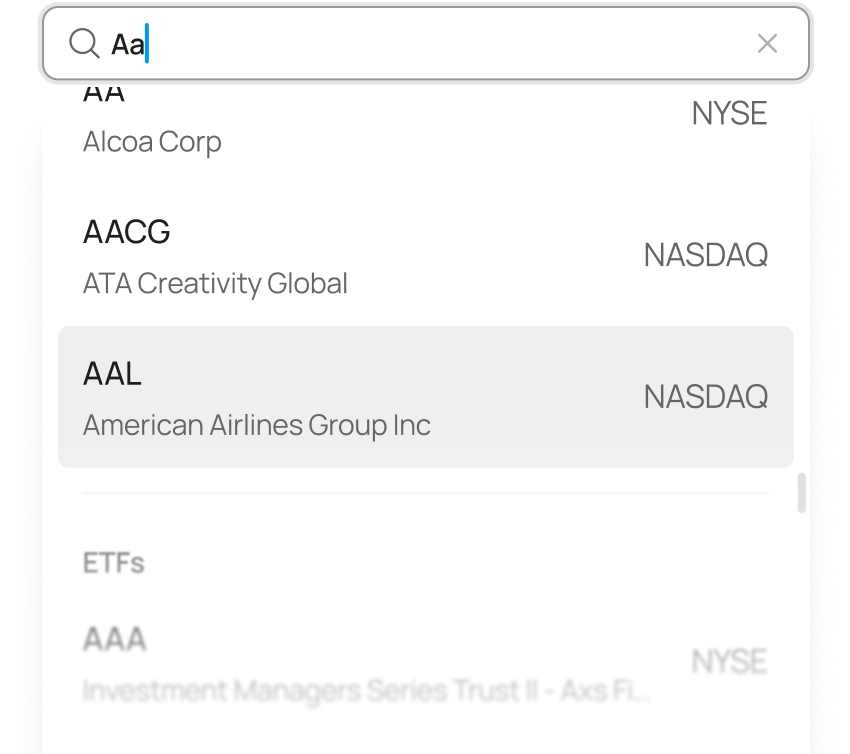

Explore. Compare. Act.

Filter stocks by category, cap, or momentum to find your next trade.

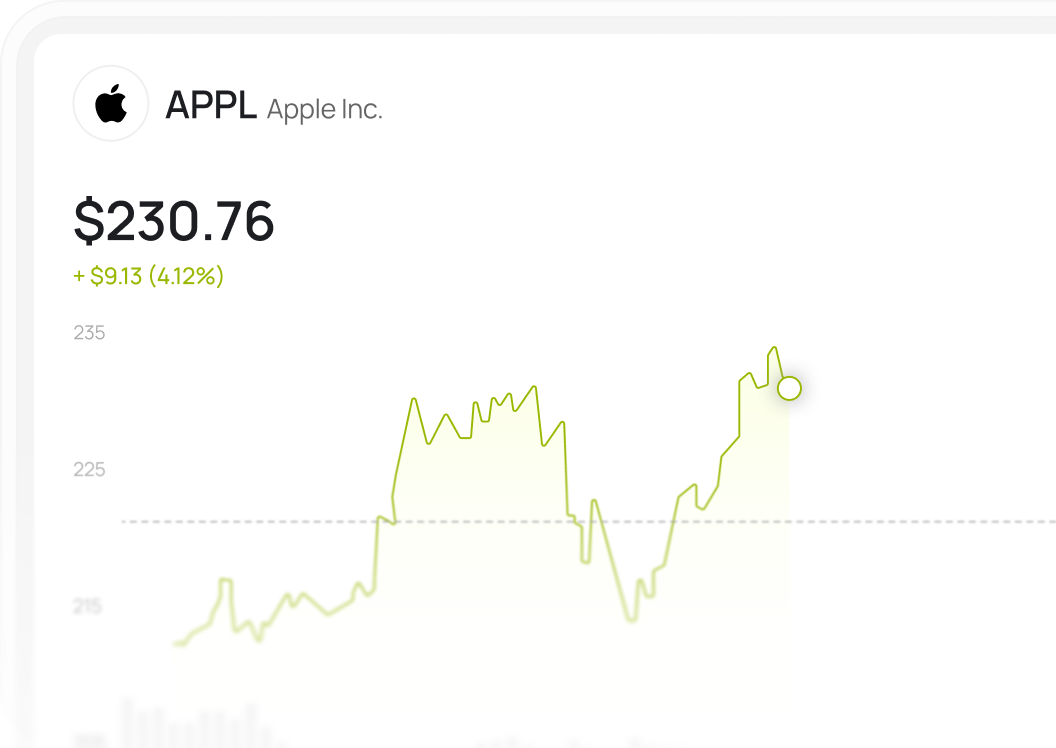

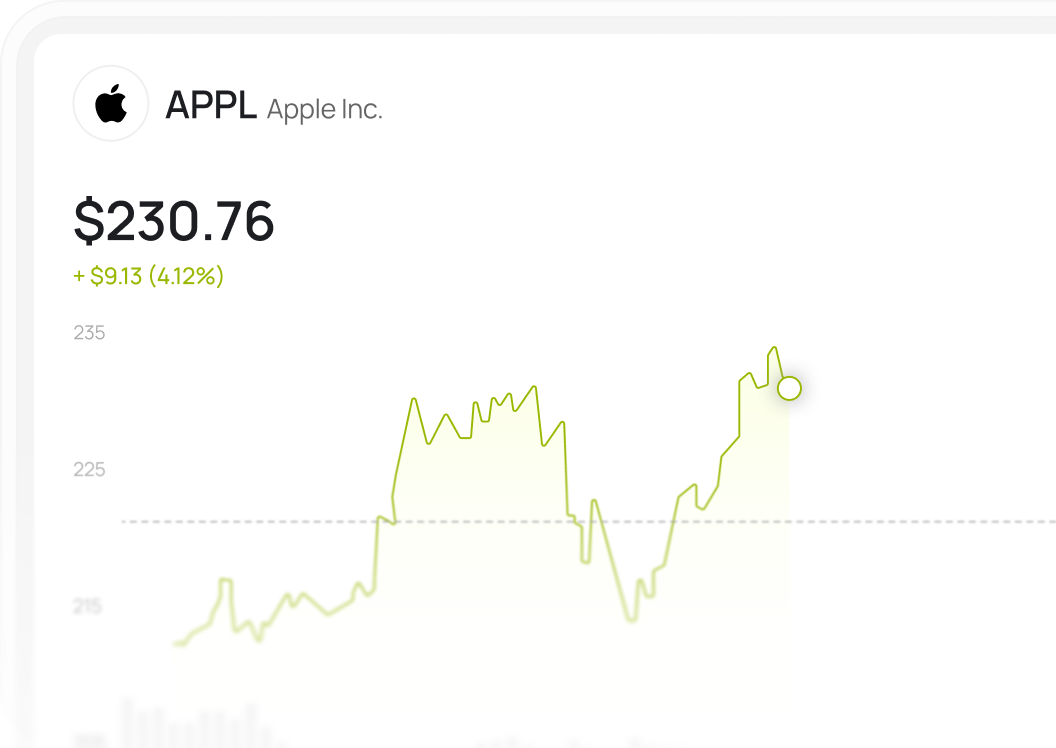

Advanced trading, simplified

Long or short U.S. stocks with direct order book access.

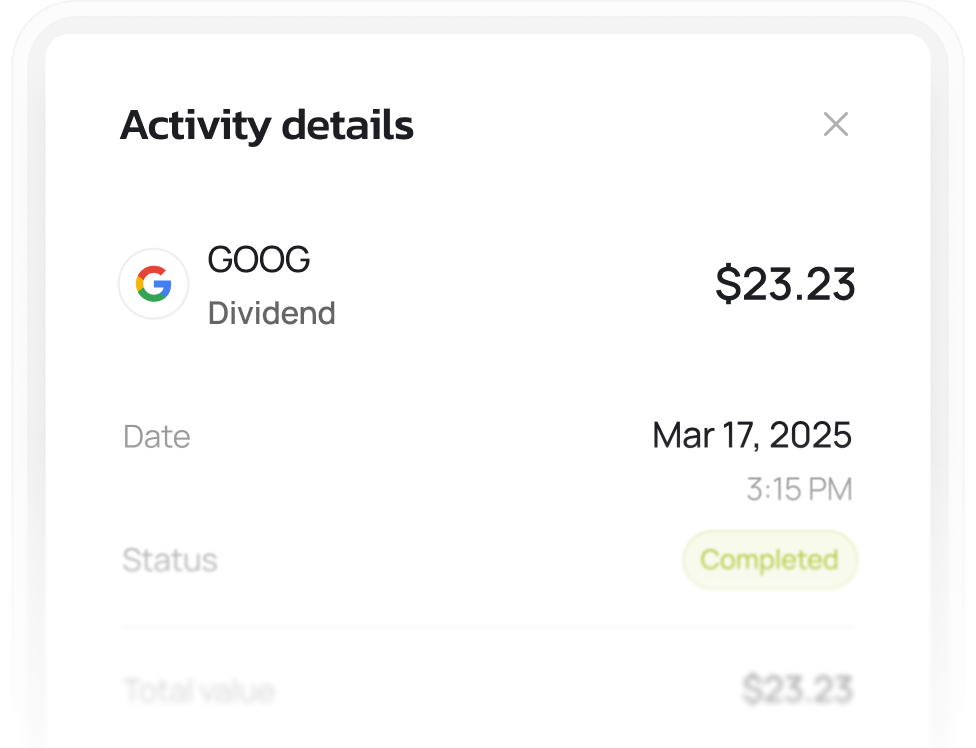

Financial institutions

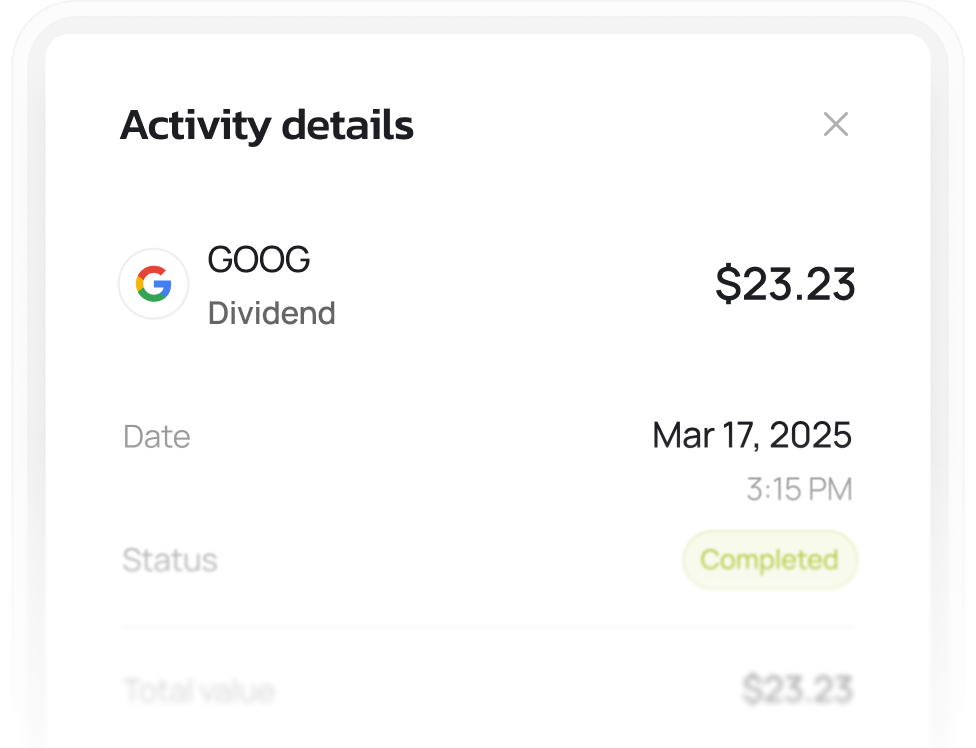

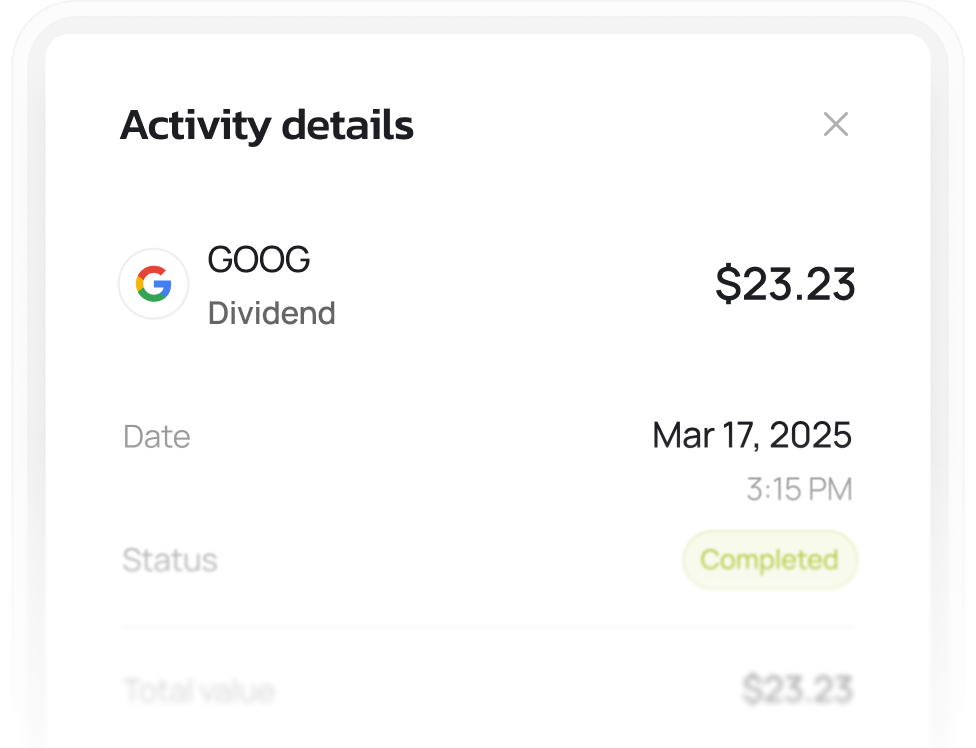

Get dividends and reports straight to your trading account.

Coming soon

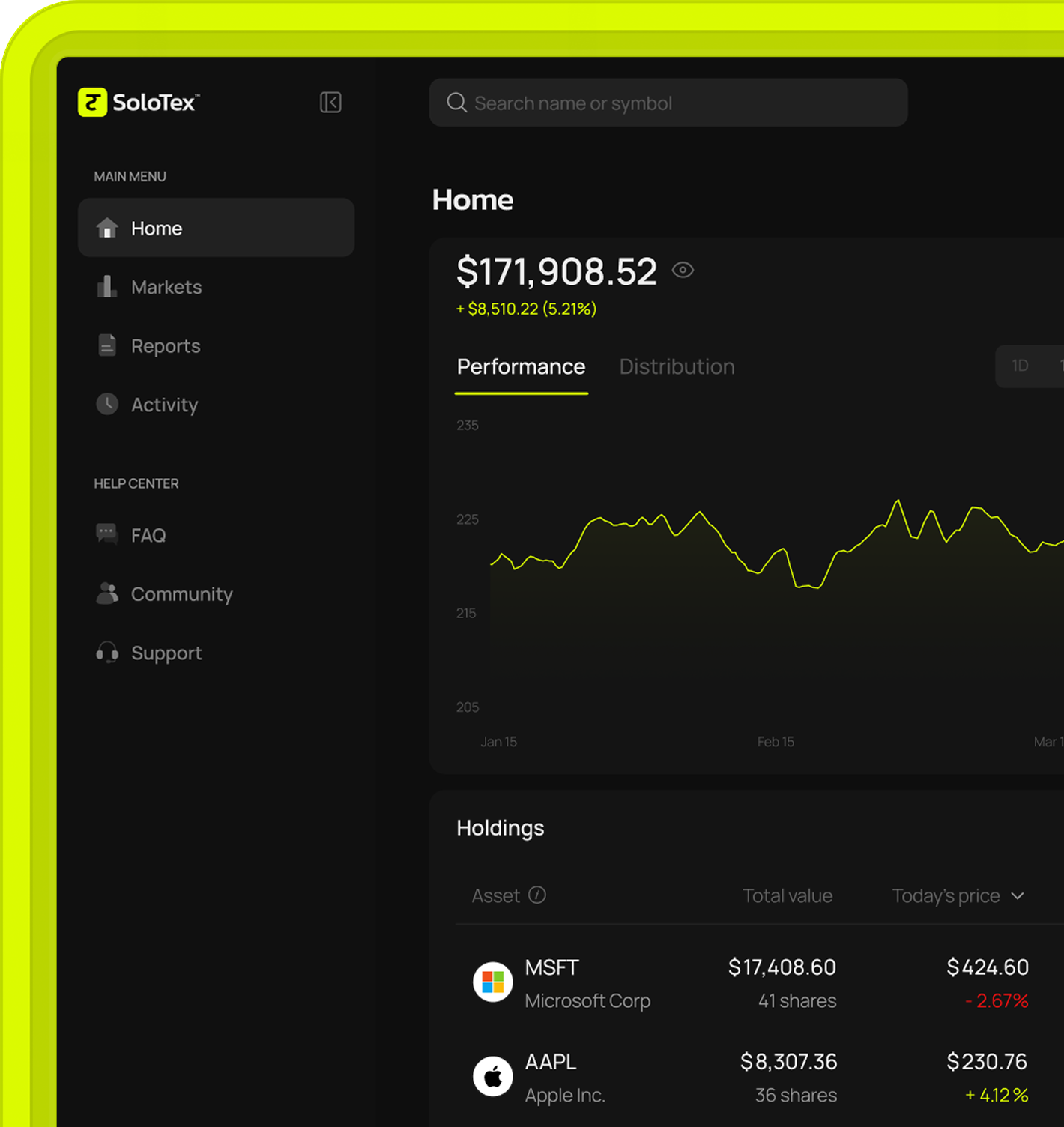

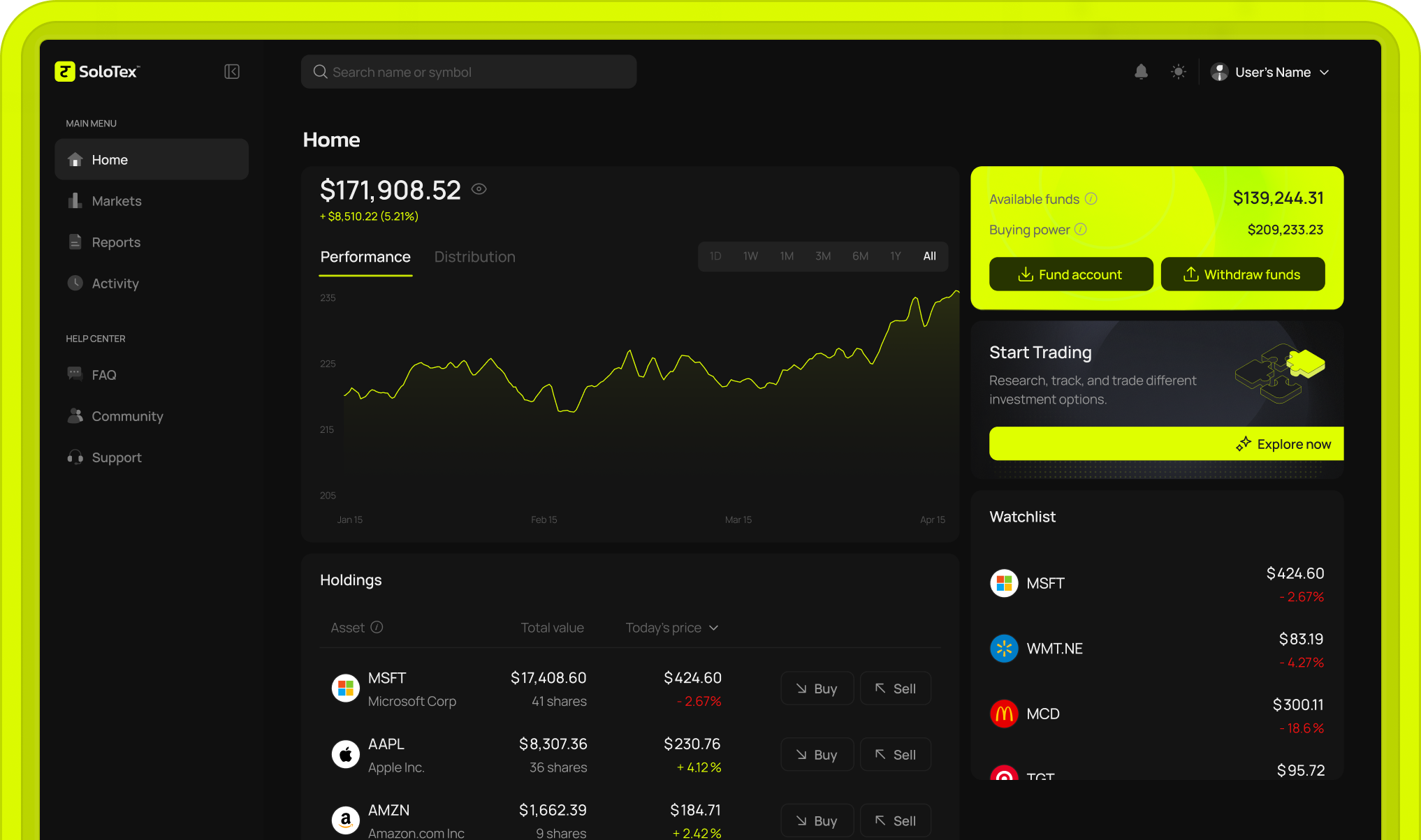

Your portfolio in your pocket

Track all your stock, ETFs, and stablecoin positions all in one wallet with the SoloTex mobile app.

Learn more

Home

$171,908.52

+ $8,510.22 (5.21%) all time

$167,653.15

+2.6%

2025-02-28

1D

1W

1M

3M

6M

1Y

Holdings

+2

View all

Watchlist

META

$563.69

-1.08%

WMT.NE

$36.23

+5.92%

MCD

$298.57

-5.12%

View all

Available funds

$139,244.31

Buying power

$209,233.23

Fund account

Withdraw funds

Partner with SoloTex

Join us in bridging the gap between Web3 and traditional finance

Financial institutions

Integrate tokenized assets and trading tools into your existing suite of products to offer access to digital and traditional investments.

Crypto exchanges

Expand your offerings with US equities, bridging the gap between crypto and traditional markets through a fully regulated environment and a US-based broker-dealer firm.

The Web3 gateway to capital markets

Track stocks, ETFs, and stablecoins all in one wallet

Apply for Early Access

Own a piece of the world’s most traded companies

Coming soon

TSLA

TSLA

TSLA

TSLA

TSLA

MSFT

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

Dow Index

44,458.30

+217.54

0.49

%

S&P 500 Index

6,263.26

+37.74

0.61

%

NASDAQ Index

6,263.26

+192.87

0.94

%

Disclaimer: The information displayed is not real-time data.

Skip the bank

Access stocks with USDC. No waiting, no friction.

Trade under a fully regulated US-based broker

Texture Capital adheres to strict U.S. securities regulations, aiming to meet the highest standards of compliance on every transaction. With SoloTex, the firm introduces a modern investment platform designed for Web3 users.

FINRA Broker Check

Everything you need to trade stocks on-chain

Explore. Compare. Act.

Filter stocks by category, cap, or momentum to find your next trade.

Advanced trading, simplified

Long or short U.S. stocks with direct order book access.

Financial institutions

Get dividends and reports straight to your trading account.

Coming soon

Your portfolio in your pocket

Track all your stock, ETFs, and stablecoin positions all in one wallet with the SoloTex mobile app.

Learn more

Home

$171,908.52

+ $8,510.22 (5.21%) all time

$167,653.15

+2.6%

2025-02-28

1D

1W

1M

3M

6M

1Y

Holdings

+2

View all

Watchlist

META

$563.69

-1.08%

WMT.NE

$36.23

+5.92%

MCD

$298.57

-5.12%

View all

Available funds

$139,244.31

Buying power

$209,233.23

Fund account

Withdraw funds

Partner with SoloTex

Join us in bridging the gap between Web3 and traditional finance

Financial institutions

Integrate tokenized assets and trading tools into your existing suite of products to offer access to digital and traditional investments.

Crypto exchanges

Expand your offerings with US equities, bridging the gap between crypto and traditional markets through a fully regulated environment and a US-based broker-dealer firm.

The Web3 gateway to capital markets

Track stocks, ETFs, and stablecoins all in one wallet

Apply for Early Access

Own a piece of the world’s most traded companies

Coming soon

TSLA

TSLA

TSLA

TSLA

TSLA

MSFT

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

TSLA

Dow Index

44,458.30

+217.54

0.49

%

S&P 500 Index

6,263.26

+37.74

0.61

%

NASDAQ Index

6,263.26

+192.87

0.94

%

Disclaimer: The information displayed is not real-time data.

Skip the bank

Access stocks with USDC. No waiting, no friction.

Trade under a fully regulated US-based broker

Texture Capital adheres to strict U.S. securities regulations, aiming to meet the highest standards of compliance on every transaction. With SoloTex, the firm introduces a modern investment platform designed for Web3 users.

FINRA Broker Check

Everything you need to trade stocks on-chain

Explore. Compare. Act.

Filter stocks by category, cap, or momentum to find your next trade.

Advanced trading, simplified

Long or short U.S. stocks with direct order book access.

Financial institutions

Get dividends and reports straight to your trading account.

Coming soon

Your portfolio in your pocket

Track all your stock, ETFs, and stablecoin positions all in one wallet with the SoloTex mobile app.

Learn more

Home

$171,908.52

+ $8,510.22 (5.21%) all time

$167,653.15

+2.6%

2025-02-28

1D

1W

1M

3M

6M

1Y

Holdings

+2

View all

Watchlist

META

$563.69

-1.08%

WMT.NE

$36.23

+5.92%

MCD

$298.57

-5.12%

View all

Available funds

$139,244.31

Buying power

$209,233.23

Fund account

Withdraw funds

Partner with SoloTex

Join us in bridging the gap between Web3 and traditional finance

Financial institutions

Integrate tokenized assets and trading tools into your existing suite of products to offer access to digital and traditional investments.

Crypto exchanges

Expand your offerings with US equities, bridging the gap between crypto and traditional markets through a fully regulated environment and a US-based broker-dealer firm.